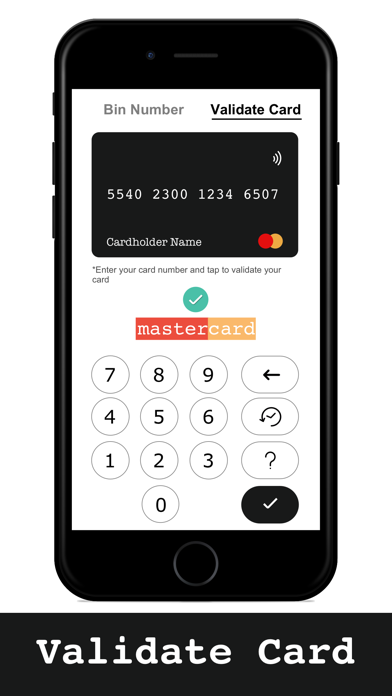

Bin Checker & Card Validator app for iPhone and iPad

Developer: Harjot Singh

First release : 15 Jul 2019

App size: 9.73 Mb

About BIN Number

A bank identification number (BIN) is the initial six numbers that appear on a credit card. The bank identification number uniquely identifies the institution issuing the card. The BIN is key in the process of matching transactions to the issuer of the charge card.

Bank identification numbers are used by other institutions, such as American Express, as well. The term "issuer identification number" (IIN) is used interchangeably with BIN. The numbering system helps identify identity theft or potential security breaches by comparing data, such as the address of the institution issuing the card and the address of the cardholder.

The BIN quickly helps a merchant identify which bank the money is being transferred from, the address, and phone number of the bank, if the issuing bank is in the same country as the device used to make the transaction. The BIN verifies the address information provided by the customer.

Features:

- The BIN number allows merchants to accept multiple forms of payment and allows faster processing of transactions.

- The number allows merchants to accept multiple forms of payment and allows transactions to be processed faster.

- The card validator helps to know the type of the card. It includes Mastercard, Visa, American Express, Discover, Diners Club, JCB, Maestro, Rupay, Mir, Elo, Hypercard, UnionPay

- Card Validator doesnt store or transmit any of your full card details over the server or any analytical tools. This feature of card validator works locally on your device only.

Please note that the application results are accurate but not perfect.The tool is provided for informational purposes only. Whilst every effort is made to provide accurate data, users must acknowledge that this app accepts no liability whatsoever with respect to its accuracy. Only your bank can confirm the correct bank account information. If you are making an important payment, which is time critical, we recommend to contact your bank first.